About Simply Solar Illinois

About Simply Solar Illinois

Blog Article

9 Easy Facts About Simply Solar Illinois Shown

Table of ContentsSimply Solar Illinois Can Be Fun For EveryoneSome Of Simply Solar IllinoisNot known Facts About Simply Solar IllinoisSimply Solar Illinois Things To Know Before You BuyNot known Details About Simply Solar Illinois

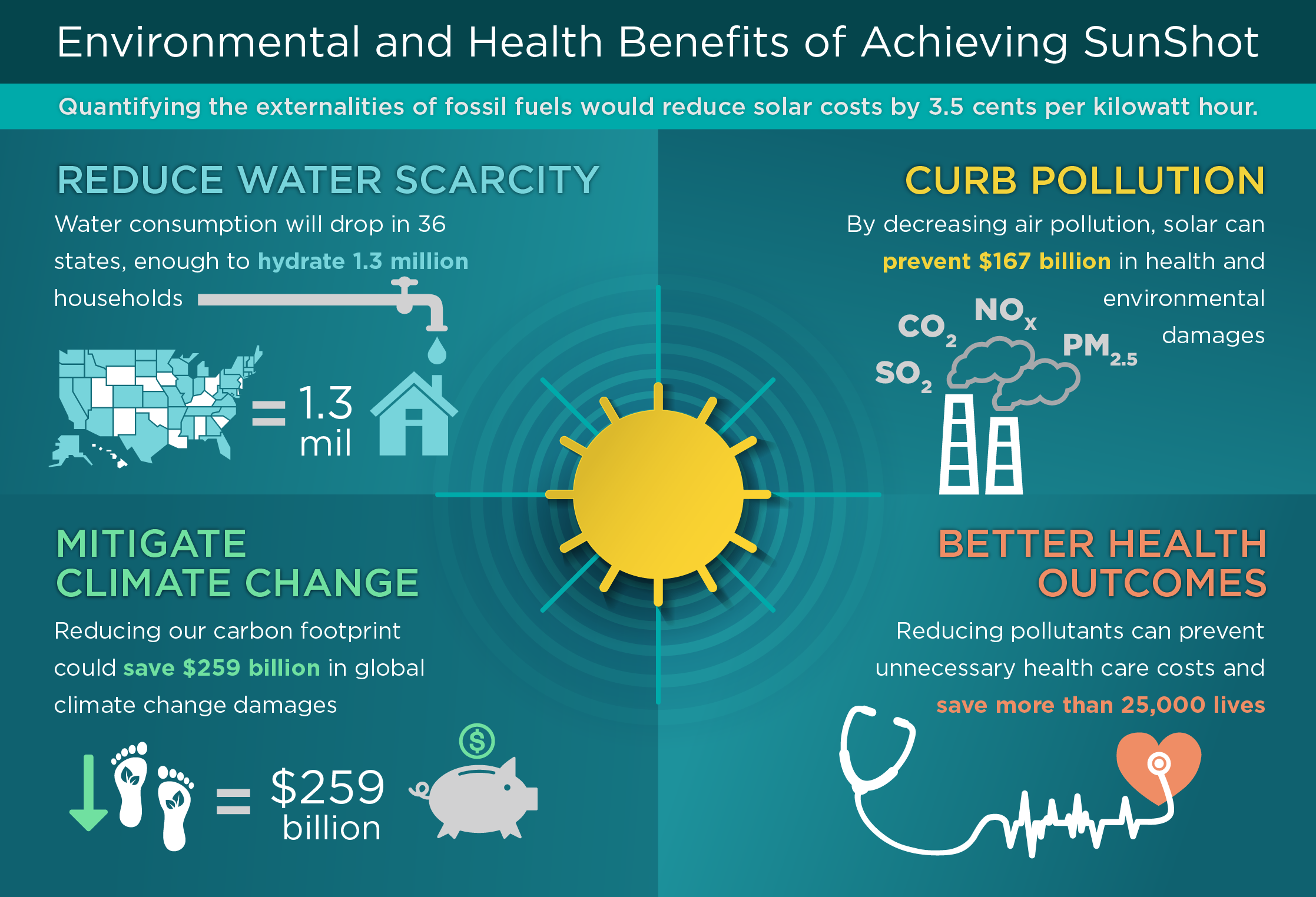

Our group companions with neighborhood neighborhoods across the Northeast and beyond to supply clean, budget friendly and dependable power to cultivate healthy and balanced neighborhoods and keep the lights on. A solar or storage space job provides a number of advantages to the neighborhood it serves. As innovation advancements and the expense of solar and storage space decline, the economic advantages of going solar remain to increase.Assistance for pollinator-friendly environment Habitat reconstruction on polluted websites like brownfields and landfills Much required shade for livestock like sheep and chicken "Land financial" for future agricultural use and soil top quality renovations Due to climate modification, severe weather is ending up being a lot more constant and disruptive. Consequently, home owners, companies, neighborhoods, and energies are all becoming more and extra interested in securing energy supply solutions that offer resiliency and power protection.

Ecological sustainability is another key driver for businesses purchasing solar power. Numerous business have durable sustainability goals that include reducing greenhouse gas exhausts and making use of less sources to aid minimize their effect on the natural surroundings. There is a growing seriousness to address environment change and the stress from consumers, is arriving degrees of organizations.

The Greatest Guide To Simply Solar Illinois

As we approach 2025, the integration of photovoltaic panels in business tasks is no more just an option however a calculated need. This blogpost looks into how solar energy jobs and the diverse benefits it gives industrial structures. Solar panels have actually been utilized on residential structures for several years, but it's only lately that they're becoming a lot more usual in industrial construction.

In this post we discuss how solar panels job and the benefits of utilizing solar power in industrial structures. Electrical energy expenses in the United state are increasing, making it a lot more costly for services to run and a lot more tough to intend in advance.

The U - Simply Solar Illinois.S. Power Details Management expects electrical generation from solar to be the leading source of growth in the united state power field with completion of 2025, with 79 GW of brand-new solar capacity forecasted ahead online over the next two years. In the EIA's Short-Term Power Overview, the firm said it anticipates renewable resource's total share of electricity generation to increase to 26% by the end of 2025

More About Simply Solar Illinois

The sunlight creates the silicon cell electrons to instate, creating an electric present. The photovoltaic solar battery soaks up solar radiation. When the silicon communicates with the sun rays, the electrons start to relocate and develop a circulation of direct electrical existing (DC). The cables feed this DC electrical power into the solar inverter and convert it see here now to rotating power (A/C).

There are a number of means to keep solar energy: When solar energy is fed into an electrochemical battery, the chain reaction on the battery parts keeps the solar power. In a reverse reaction, the existing departures from the battery storage for consumption. Thermal storage uses tools such as liquified salt or water to preserve and absorb the warmth from the sunlight.

Solar panels substantially reduce energy prices. While the initial financial investment can be high, overtime the expense of setting up solar panels is recovered by the cash saved on power bills.

Things about Simply Solar Illinois

By setting up photovoltaic panels, a brand reveals that it appreciates the environment and is making an effort to minimize its carbon footprint. Structures that depend totally on electrical grids are prone to power interruptions that happen during negative weather condition or electrical system breakdowns. Photovoltaic panel mounted with battery systems permit industrial buildings to remain to operate during power outages.

The Simply Solar Illinois PDFs

Solar power is one of the cleanest forms of power. With long-lasting service warranties and a manufacturing life of approximately 40-50 years, solar financial investments add considerably to environmental sustainability. This shift towards cleaner energy resources can bring about more comprehensive financial benefits, including lowered environment modification and ecological deterioration costs. In 2024, home owners can take advantage of federal solar tax rewards, allowing them to balance out nearly one-third of the purchase cost of a planetary system through a 30% tax credit rating.

Report this page